Difference between revisions of "Pharmacy billing and reimbursement"

From Rx-wiki

(→Terminology) |

(→Pharmacy billing cycle) |

||

| Line 79: | Line 79: | ||

<li>Payment processing</li> | <li>Payment processing</li> | ||

</ol> | </ol> | ||

| − | <p>While parts of this process | + | <p>While parts of this process are also already covered in [[Medication Order Entry and Fill Process]], this article will be focusing on the correlation between these processes and pharmacy billing/reimbursement.</p> |

===Receiving the prescription=== | ===Receiving the prescription=== | ||

<p>When a community pharmacy receives a prescription, it is a requirement to note the source of the prescription if it is for a Medicare or Medicaid patient. As many individual insurance companies also require this information, it has become a common practice for community pharmacies to track where all prescriptions come from. These prescriptions are tracked using prescription origin codes (POC), which are commonly entered into the pharmacy management software. The prescription origin codes are as follows:</p> | <p>When a community pharmacy receives a prescription, it is a requirement to note the source of the prescription if it is for a Medicare or Medicaid patient. As many individual insurance companies also require this information, it has become a common practice for community pharmacies to track where all prescriptions come from. These prescriptions are tracked using prescription origin codes (POC), which are commonly entered into the pharmacy management software. The prescription origin codes are as follows:</p> | ||

Revision as of 08:14, 6 February 2014

This article will focus on the following knowledge areas related to pharmacy billing and reimbursement:

- Reimbursement policies and plans (e.g., HMOs, PPO, CMS, private plans)

- Third-party resolution (e.g., prior authorization, rejected claims, plan limitations)

- Third-party reimbursement systems (e.g., PBM, medication assistance programs, coupons, and self-pay)

- Healthcare reimbursement systems (e.g., home health, long-term care, home infusion)

- Coordination of benefits

Contents

Terminology

To get started in this article, there are some terms that should be defined.

out-of-pocket - Out-of-pocket expenses are the costs that are considered the responsibility of the patient, including non-covered items, deductibles, and copays.

third-party payor - A third-party payor (also spelled payer) is an organization other than the patient (first party) or pharmacy/health care provider (second party) involved in the financing of personal health services including, but not limited to, prescriptions medication.

fraud - Fraud can be broadly defined as an act of deliberate deception performed to acquire an unlawful benefit. In a pharmacy, that may include billing for a medication or device the patient did not receive, or over billing for a medication or device that the patient did receive.

bank identification number (BIN) - On a health insurance card, a BIN is a six digit number used to identify a specific plan from a carrier making it easier for the PBM to process your prescription online. No actual bank is involved in this part of the process (the name is a hold over from early electronic banking terminology).

group number - A group number identifies your group, or business, from other groups, or businesses, who are insured by the same insurance company.

member number - A member number is a number in correlation to relationship to the family member that provides the insurance. Typically, the individual that is primarily insured has a member number of '00' or '01' and the next number is reserved for their spouse (even if the individual is not currently married). Therefore, the spouse would be either '01' or '02'. Then, any children that they provide insurance for continues consecutively from oldest to youngest.

Processor Control Number (PCN) - The Processor Control Number (PCN) is a secondary identifier for insurance that may be used in the routing of pharmacy transactions by the processor to aid in the receipt and adjudication of prescription claims. A PBM/processor/plan may choose to differentiate different plans/benefit packages with the use of unique PCNs. The PCN is an alphanumeric number defined by the PBM/processor, as this identifier is unique to their business needs. There is no official registry of PCNs.

private insurance - Private insurance plans are ones that consumers receive through their employer (or their family member's employer), or through individual purchases.

public insurance - Public insurance is insurance either provided by or subsidized by the government, such as Medicare and Medicaid.

managed care - Managed care (a term used to describe most health insurance policies) is used to describe a variety of techniques intended to reduce the cost of health benefits and improve the quality of care.

health maintenance organization (HMO) - A health maintenance organization (HMO) covers care provided by health professionals who have signed up with the HMO, and have agreed to treat patients according to the HMO’s policies.

preferred provider organization (PPO) - A preferred provider organization (PPO) is an insurance plan in which participating health care professionals and hospitals treat patients for an agreed upon rate.

exclusive provider organization (EPO) - An exclusive provider organization (EPO) is an insurance plan in which only authorized health care professionals and hospitals treat patients for an agreed upon rate. This plan is usually more exclusive than a PPO.

Centers for Medicare & Medicaid Services (CMS) - The Centers for Medicare & Medicaid Services (CMS), previously known as the Health Care Financing Administration (HCFA), is a federal agency within the United States Department of Health and Human Services (DHHS) that administers the Medicare program and works in partnership with state governments to administer Medicaid, the State Children's Health Insurance Program (SCHIP), and health insurance portability standards.

Medicare - Federal health insurance program for patients 65 years old and above, some younger patients with disabilities, and some people with permanent kidney failure (end-stage renal disease).

Medicare Part A - Medicare Part A is the part of Medicare that pays for hospital care.

Medicare Part B - Medicare Part B is the part of Medicare that pays for doctor visits, certain injections, durable medical equipment, chemotherapy, and diabetes supplies (not insulin).

Medicare Part C - Medicare Part C, also called a Medicare Advantage Plan, is a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.

Medicare Part D - Medicare Part D is the part of Medicare that pays for prescription drug coverage. Medicare Part D covers outpatient prescription drugs exclusively through private plans or through Medicare Advantage plans that offer prescription drugs.

Medicaid - This is a joint federal and state program that helps with medical costs for some people with low incomes and limited resources. Medicaid programs vary from state to state. Some patients are covered by both Medicaid and Medicare.

National Council for Prescription Drug Programs (NCPDP) - The National Council for Prescription Drug Programs (NCPDP) is a nonprofit organization that create national standards for electronic health care transactions used in prescribing, dispensing, monitoring, managing and paying for medications and pharmacy services. The NCPDP also develop standardized business solutions and best practices that safeguard patients.

switch vendor - A switch vendor routes prescription information from the pharmacy management software to ensure that the information conforms to the NCPDP standards prior to routing it to the PBM.

prior authorization - If a medication is not normally covered by an insurance, is a particularly high dose, has significant risk potential, is being used to treat or ameliorate off-label disease(s)/condition(s), or is not usually recommended for a particular age or gender, the physician and/or the pharmacy may need to acquire prior authorization in order to get the insurance to cover the medication.

coordination of benefits - Determining which insurance should be considered primary, secondary, tertiary, etc. is sometimes referred to as coordination of benefits; although, that term is more commonly used if one of the insurance plans involve Medicare.

adjudication - Adjudication is a term used in the insurance industry to refer to the process of paying claims submitted or denying them after comparing claims to the benefit or coverage requirements.

remittance advice (RA) - Remittance advice (RA) is a document sent to the pharmacy by the insurance company providing the details of a paid claim. This is also referred to as an explanation of benefits (EOB).

fee-for-service reimbursement - Fee-for-service reimbursement is a payment method in which providers receive payment for each service rendered.

episode-of-care reimbursement - Episode-of-care reimbursement is a payment method in which providers receive one lump sum for all the services they provide related to a condition or disease.

Health insurance

In an era of high medical costs (2012 saw an annual expenditure of $325.8 billion on prescription medications according to the IMS Institute for Healthcare Informatics), and the expectation of greater numbers of insured persons due to the individual mandate in the Patient Protection and Affordable Care Act (scheduled to take effect in January 2014), it is increasingly important to understand and properly process insurance claims. Pharmacies need to bill patients for their medications, medical supplies, and for services rendered (medication therapy management), and it is important to properly enter the necessary information and process claims correctly to avoid allegations of fraud.

Remuneration for pharmaceutical goods and counseling can be broken into three very broad groups: private insurance, public insurance, and cash. Private insurance plans are ones that consumers receive through their employer (or their family member's employer), or through individual purchases (which includes the online health exchanges mandated by the Patient Protection and Affordable Care Act). Public insurance is insurance either provided by or subsidized by the government, such as Medicare and Medicaid. Cash, while less common, is another option if the individual receiving the product either doesn't want to process it through their insurance, doesn't have insurance, or if the consumer still wants it after their insurance rejects it.

According to information published by the United States Census Bureau in 2011, roughly 55% of Americans obtain private insurance through an employer, while about 10% purchase it directly. About 31% of Americans were enrolled in a public health insurance program: 14.5% (45 million – although, that number has since risen to 48 million) had Medicare, 15.9% (49 million) had Medicaid, and 4.2% (13 million) had military health insurance (as there is some overlap with individuals having multiple plans, the percentages add up to more than 100%).

Private insurance health plans

Private health insurance may be purchased on a group basis (by a firm to cover its employees) or purchased by individual consumers. Most Americans with private health insurance receive it through an employer-sponsored program. According to information published by the United States Census Bureau in 2011, some 55% of Americans are covered through an employer sponsored program, while about 10% purchase health insurance directly. As additional portions of the Patient Protection and Affordable Care Act of 2010 come into effect, both of these numbers will likely rise due to the individual and employer mandates. In 2014, individuals not obtaining health insurance will receive a fine, and in 2015 employers with 50 or more full-time employees will also be fined if they do not offer health insurance to their full-time employees.

These health insurance plans may take a variety of forms, but most of them can be categorized as managed care. The term managed care is used to describe a variety of techniques intended to reduce the cost of health benefits and improve the quality of care. It is also used to describe organizations that use these techniques ("managed care organization"). Most managed care organizations are either health maintenance organizations (HMOs), preferred provider organizations (PPOs), or exclusive provider organizations (EPOs).

Public (government) health plans

Public health insurance programs provide the primary source of coverage for most seniors and for low-income children and families who meet certain eligibility requirements. The primary public programs are Medicare, a federal social insurance program for seniors (generally persons aged 65 and over) and certain disabled individuals; Medicaid, funded jointly by the federal government and states, but administered at the state level, which covers certain very low income children and their families; and State Children's Health Insurance Program (SCHIP), also a federal-state partnership that serves certain children and families who do not qualify for Medicaid, but who cannot afford private coverage. Other public programs include military health benefits provided through TRICARE and the Veterans Health Administration and benefits provided through the Indian Health Service. Some states have additional programs for low-income individuals.

Medicare

Medicare is a national social insurance program administered by the Centers for Medicare & Medicaid Services (CMS) that guarantees access to health insurance for Americans aged 65 and older, and younger people with disabilities, as well as people with end stage renal disease and individuals with ALS. In 2010, Medicare provided health insurance to 48 million Americans, 40 million people age 65 and older, and eight million younger people with disabilities.

Medicare offers all enrollees a defined benefit. Hospital care is covered under Part A, and outpatient medical services are covered under Part B. To cover the Part A and Part B benefits, Medicare offers a choice between an open-network single payer health care plan (traditional Medicare) and a network plan (Medicare Advantage, or Medicare Part C), where the federal government pays for private health coverage. According to 2012 statistics, 76% of Medicare enrollees have traditional Medicare, while 24% have enrolled in the Medicare Advantage plan. Medicare Part D covers outpatient prescription drugs exclusively through private plans or through Medicare Advantage plans that offer prescription drugs.

Medicaid

Medicaid is a government insurance program for people of all ages whose income and resources are insufficient to pay for health care. Medicaid is overseen by the Centers for Medicare and Medicaid Services. Medicaid is the largest source of funding for medical and health-related services for people with low income in the United States. It is a means-tested program that is jointly funded by the state and federal governments, and managed by the states, with each state currently having broad leeway to determine who is eligible for its implementation of the program. Medicaid recipients must be U.S. citizens or legal permanent residents, and may include low-income adults, their children, and people with certain disabilities. Poverty alone does not necessarily qualify someone for Medicaid.

The Patient Protection and Affordable Care Act will significantly expand both eligibility for and federal funding of Medicaid beginning on January 1, 2014. Under the law as written, all U.S. citizens and legal residents with income up to 133% of the poverty line, including adults without dependent children, would qualify for coverage. However, the United States Supreme Court ruled in National Federation of Independent Business v. Sebelius that states do not have to agree to this expansion in order to continue to receive existing levels of Medicaid funding, and many states have chosen to continue with current funding levels and eligibility standards.

Other government sponsored programs

Besides Medicare and Medicaid, the government commonly provides assistance to a broad array of groups, including children and pregnant women (State Children’s Health Insurance Program), military veterans (Veterans Health Administration), the families of military personnel (TRICARE), and native Americans (Indian Health Service).

SCHIP

The State Children’s Health Insurance Program (SCHIP), more commonly known as the Children’s Health Insurance Program (CHIP) is a joint state and federal program to provide health insurance to children in families who earn too much money to qualify for Medicaid, yet cannot afford to buy private insurance. This also includes prenatal care for women during their pregnancy, provided they meet the established financial criteria. SCHIP programs are run by the individual states according to requirements set by the federal Centers for Medicare and Medicaid Services (CMS), and may be structured as independent programs separate from Medicaid (separate child health programs), as expansions of their Medicaid programs (SCHIP Medicaid expansion programs), or combine these approaches (SCHIP combination programs).

TRICARE

TRICARE, formerly known as the Civilian Health and Medical Program of the Uniformed Services (CHAMPUS), is a health care program of the United States Department of Defense Military Health System. Tricare provides civilian health benefits for military personnel, military retirees, and their dependents, including some members of the Reserve Component. The Tricare program is managed by Tricare Management Activity (TMA) under the authority of the Assistant Secretary of Defense (Health Affairs). Tricare is the civilian care component of the Military Health System (although historically it also included health care delivered in the military medical treatment facilities).

CHAMPVA

Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) is a health benefits program managed by the Department of Veterans Affairs (VA) for eligible beneficiaries. Eligible beneficiaries include the spouse or widow(er), and to the children of a veteran who is rated permanently and totally disabled due to a service-connected disability, or was rated permanently and totally disabled due to a service-connected condition at the time of death, or died of a service-connected disability, or died on active duty and the dependents are not otherwise eligible for TRICARE benefits.

Veterans Health Administration

The Veterans Health Administration (VHA) is the component of the United States Department of Veterans Affairs (VA) that implements the medical assistance program of the VA through the administration and operation of numerous VA outpatient clinics, hospitals, medical centers and long-term healthcare facilities (i.e., nursing homes). By Federal law, eligibility for benefits is determined by a system of eight Priority Groups. Retirees from military service, veterans with service-connected injuries or conditions rated by VA, and Purple Heart recipients are within the higher priority groups.

Indian Health Service

The Indian Health Service (IHS) is an operating division (OPDIV) within the U.S. Department of Health and Human Services (HHS). IHS is responsible for providing medical and public health services to members of federally recognized Tribes and Alaska Natives. IHS is the principal federal health care provider and health advocate for Indian people, and its goal is to raise their health status to the highest possible level.

Workers' compensation

Workers' compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment. Workers' compensation benefits vary according to state law.

Pharmacy billing cycle

The pharmacy billing pathway in most community pharmacies can be broken into the following steps:

- Receiving the prescription

- Gathering patient data

- Data entry

- Pharmacy claim transmittal

- Third-party payor adjudication

- Point-of-sale

- Payment processing

While parts of this process are also already covered in Medication Order Entry and Fill Process, this article will be focusing on the correlation between these processes and pharmacy billing/reimbursement.

Receiving the prescription

When a community pharmacy receives a prescription, it is a requirement to note the source of the prescription if it is for a Medicare or Medicaid patient. As many individual insurance companies also require this information, it has become a common practice for community pharmacies to track where all prescriptions come from. These prescriptions are tracked using prescription origin codes (POC), which are commonly entered into the pharmacy management software. The prescription origin codes are as follows:

0 = Unknown is used when the manner in which the original prescription was received is not known, which may be the case in a transferred prescription.

1 = Written prescription via paper, which includes computer printed prescriptions that a physician signs as well as tradition prescription forms

2 = Telephone prescription obtained via oral instruction or interactive voice response

3 = E-prescriptions securely transferred from a computer to the pharmacy

4 = Facsimile prescription obtained via fax transmission, including an e-Fax where a scanned image is sent to the pharmacy, and either printed or displayed on a monitor/screen

Gathering patient data

When a patient first arrives at a community pharmacy, the pharmacy team will need to gather/verify various important pieces of patient data including:

- gather drug and disease information,

- ensure that the pharmacy has the correct name, address, date of birth, contact information, and any other pertinent data,

- document/update allergy information,

- verify/update medication insurance information, which includes coverage type (primary, secondary, etc.), insurance name and bank identification number (BIN), group number, and member number.

Data entry

Pharmacy staff will need to enter information into the pharmacy software management system in order to process the prescription. Common information to require includes:

- Prescriber information -This typically includes the prescriber's name, address of practice, contact information, medical license number, DEA number, and National Provider Identifier (NPI).

- Third-party payor - This includes coverage type (primary, secondary, etc.), insurance name and bank identification number (BIN), group number, and member number. If a patient has multiple insurance plans, be sure to enter them correctly as primary, secondary, etc.

- Patient information - The patient information should at least include name, date of birth, address, contact information, allergies, and payment type (cash vs. insurance). Often, pharmacies will request information on concurrent use of other medications and dietary supplements, preferences with respect to safety lids, and verification that the patient has received notification of the pharmacy's privacy policy.

- Prescription information - While many items on a prescription are important, the system should record as a minimum the date the prescription was written, superscription, inscription, subscription, signatura, refills, prescription origin code, and it should generate a unique prescription number that should appear on the prescription label as well.

- DAW codes - Dispense as written (DAW) codes need to be entered into the computer as well. Most prescriptions allow for generic substitution, and patients are glad to receive the more affordable version; therefore, the default DAW code is typically set to '0'. If a physician requires a specific medication to be dispensed, they will typically note this on the prescription. This is considered a DAW code of '1'. Sometimes a patient may request that they receive a brand name product even if a prescriber allowed for generic substitution. This would be classified as a DAW code of '2'. Other DAW codes are less frequently used. The following is a succinct list of the other DAW codes; 3 = substitution allowed - pharmacist selected product dispensed, 4 = substitution allowed - generic drug not in stock, 5 = substitution allowed - brand drug dispensed as generic, 6 = override, 7 = substitution not allowed - brand drug mandated by law, 8 = substitution allowed - generic drug not available in marketplace, and 9 = Other.

- Drug information - At a minimum, drug information should include the drug name, the medication's National Drug Code (NDC), the manufacturer, and an ability to check for interactions and contraindications. Often this drug information will include information on auxiliary labels, specific lot numbers and expiration dates, stock availability, pricing, and medication guides.

Pharmacy claim transmittal

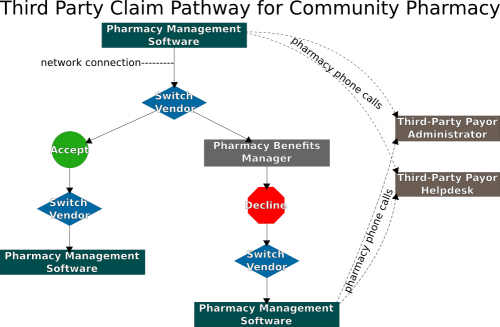

At this point, the pharmacy is ready to transmit the prescription. This process is diagrammed on the right. When the prescription transmits, it goes through the switch vendor, and is either accepted (approved) or sent on to the PBM. If declined, the pharmacy, the prescriber, and/or the patient will need to contact either the PBM, or the third-party payor to attempt to obtain approval. If a patient has multiple insurance plans, most pharmacy management software systems are capable of performing split-billing. Determining which insurance should be considered primary, secondary, tertiary, etc. is sometimes referred to as coordination of benefits; although, that term is more commonly used if one of the insurance plans involve Medicare.Common reasons for rejections include:

- a noncovered medication, or a medication requiring prior authorization,

- incorrect days' supply of medication, refill too soon, or invalid quantity of medication being dispensed,

- the patient's insurance on file is not currently active, or has been incorrectly entered, and

- the prescriber's information is either incomplete or entered incorrectly.

To assist in the resolution of declined prescriptions, the NCPDP has established a standardized set of reject codes. Some common examples include:

01 = Missing/Invalid BIN

09 = Missing/Invalid Birth Date

11 = Missing/Invalid Relationship Code

19 = Missing/Invalid Days Supply

25 = Missing/Invalid Prescriber ID

66 = Patient Age Exceeds Maximum Age

70 = Product/Service Not Covered

75 = Prior Authorization Required

79 = Refill Too Soon

Third-party payor adjudication

Once the prescription is accepted, the claim is adjudicated by the payor. The payor compares the charges with the terms of the patient’s benefit plan, and determines what the patient owes, as well as what the insurance plan is financially responsible for. This information is then returned to the pharmacy electronically. Because this transaction process occurs in a matter of seconds, it is sometimes referred to as real-time claim adjudication (RTCA).

Point-of-sale

Once the medication has been filled and checked, it is ready for the patient to pick it up, which usually involves any additional payments (copays, deductibles, or if a particular medication is not covered, then the usual and customary price), the offering of medication counseling, and the proper recording and filing of dispensed prescriptions. Common payment options include coupons from the manufacturers, cash, checks, credit cards, and debit cards. Often, the pharmacy management system can handle this portion of the prescription filling process as well.

Payment processing

The insurance companies will send out payments (electronically or by paper check) to the pharmacies every thirty to sixty days for all prescriptions processed within a particular time frame. This payment is typically accompanied by a remittance advice (RA), also known as an explanation of benefits, providing details about the paid claims.

Other healthcare reimbursement methodologies

So far, this chapter has focused on third-party payor reimbursement in community pharmacy settings. Healthcare reimbursement often works differently in other practice settings (home health, long-term care, home infusion, etc.). The two major types of payment in these practice settings include fee-for-service reimbursement or episode-of-care reimbursement.

Fee-for-service reimbursement is a payment method in which providers receive payment for each service rendered. A fee is a set amount or a set price. Fee-for-service means a specific payment is made for each specific service rendered. In the fee-for-service method, the provider of the healthcare service charges a fee for each type of service, and the health insurance company pays each fee for a covered service. These fees or prices are known as charges in healthcare. Typically, the pharmacy or healthcare organization bills for each service provided on claims that have specific values associated with them. The claim is submitted to the third party payor, and the insurance company will send out payments covering windows of time and include remittance advices.

Episode-of-care reimbursement is a payment method in which providers receive one lump sum for all the services they provide related to a condition or disease. In the episode-of-care payment method, the unit of payment is the episode, not each individual health service. Therefore, the episode-of-care payment method eliminates individual fees or charges. The episode-of-care payment method controls costs on a systematic scale. If a specific amount is contracted to the pharmacy, this may also be referred to as a capitation fee.

See also

Medication order entry and fill process

References

- Wikipedia, Health insurance in the United States, http://en.wikipedia.org/wiki/Health_insurance_in_the_United_States

- Centers for Medicare & Medicaid Services, Prescription Drug Benefit Manual - Chapter 7, https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovContra/downloads/Chapter7.pdf

- National Council for Prescription Drug Programs, External Code List, http://www.ncpdp.org/members/stds-102508/external_code_list_201003.pdf

- IMS Institute for Healthcare Informatics, IMS Health Study Points to a Declining Cost Curve for U.S. Medicines in 2012, http://www.imshealth.com/portal/site/ims/menuitem.d248e29c86589c9c30e81c033208c22a/?vgnextoid=8659cf4add48e310VgnVCM10000076192ca2RCRD&vgnextchannel=437879d7f269e210VgnVCM10000071812ca2RCRD

- Medical Insurance for Pharmacy Technicians, Chapter 1 From Prescription to Payment: Becoming a Pharmacy Technician Insurance Specialist, Janet Liles, McGraw-Hill, 2010, ISBN: 9780073374161, http://highered.mcgraw-hill.com/sites/dl/free/0073374164/638139/Chapter01.pdf

- Clerical and Data Management for the Pharmacy Technician, Linda Quiett, 2012, ISBN: 978-1-4390-5781-0

- National Center for Health Statistics, DAW Codes, http://www.ncvhs.hhs.gov/970416w2.htm

- Billing for Rx drugs. Pharmacist’s Letter/Pharmacy Technician’s Letter 2009 (updated June 2011);25(2):250212

- United States Census Bureau, Health Insurance Main, http://www.census.gov/hhes/www/hlthins/

- Wikipedia, Patient Protection and Affordable Care Act, http://en.wikipedia.org/wiki/Patient_Protection_and_Affordable_Care_Act

- PRS Pharmacy Services, third party claim pathway, further information not available